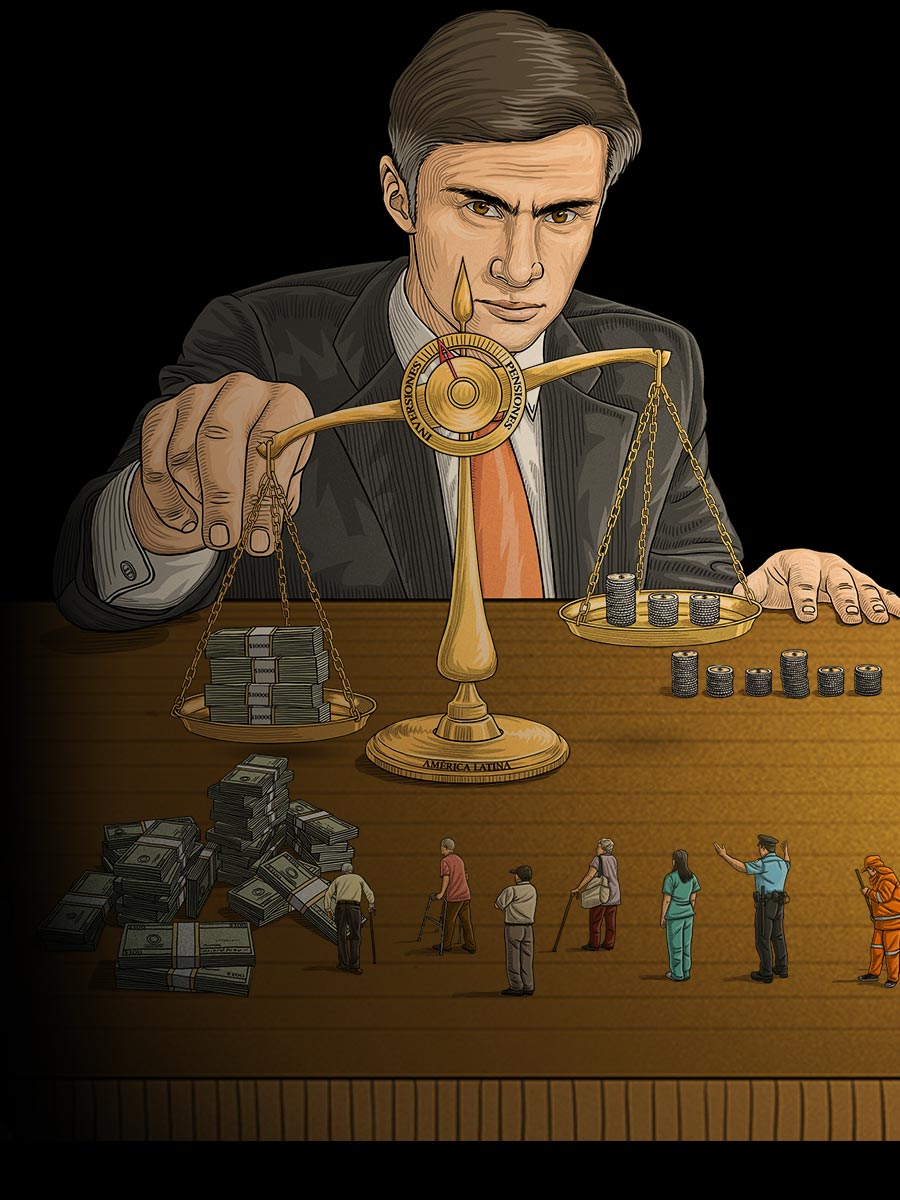

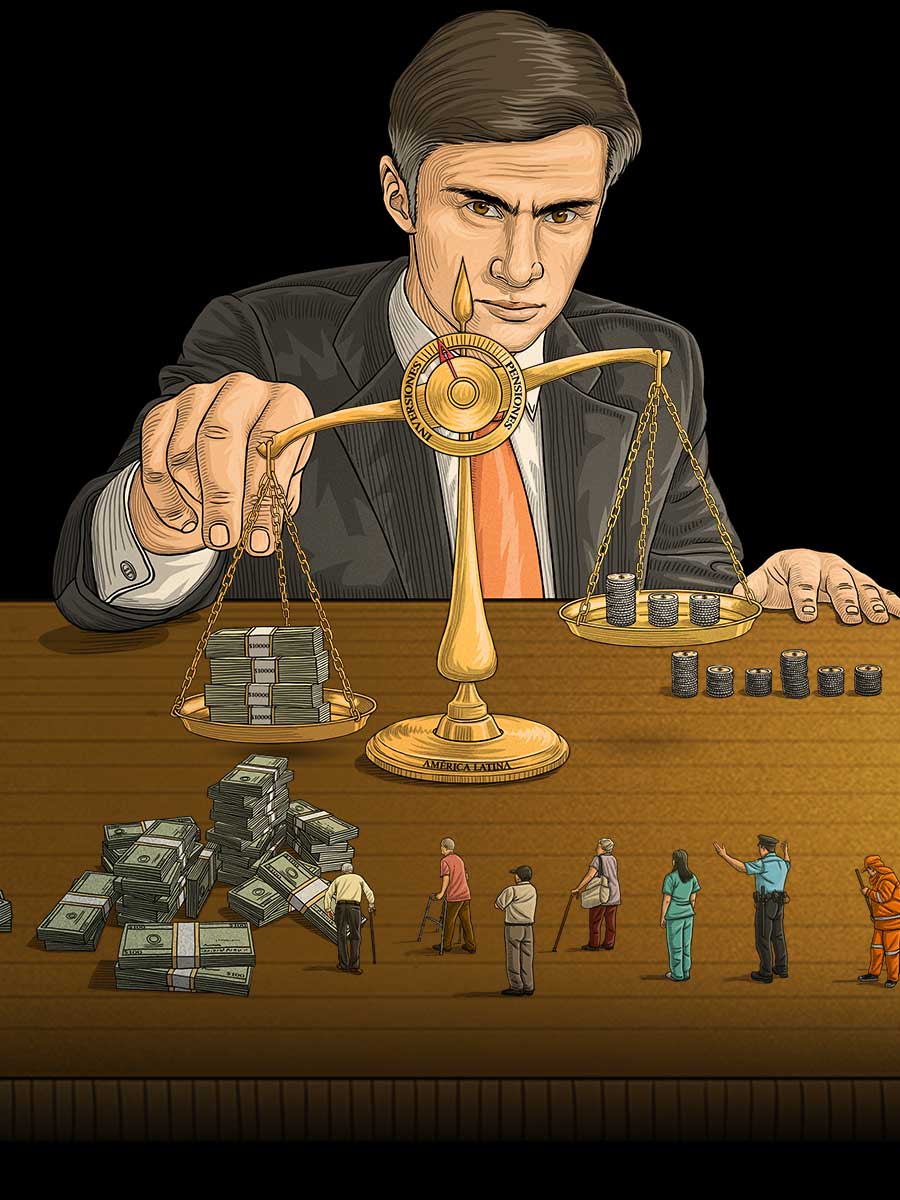

Workers in nine Latin American countries have managed to save around $500 billion through their pension systems, but they do not know who they have been financing throughout the years.

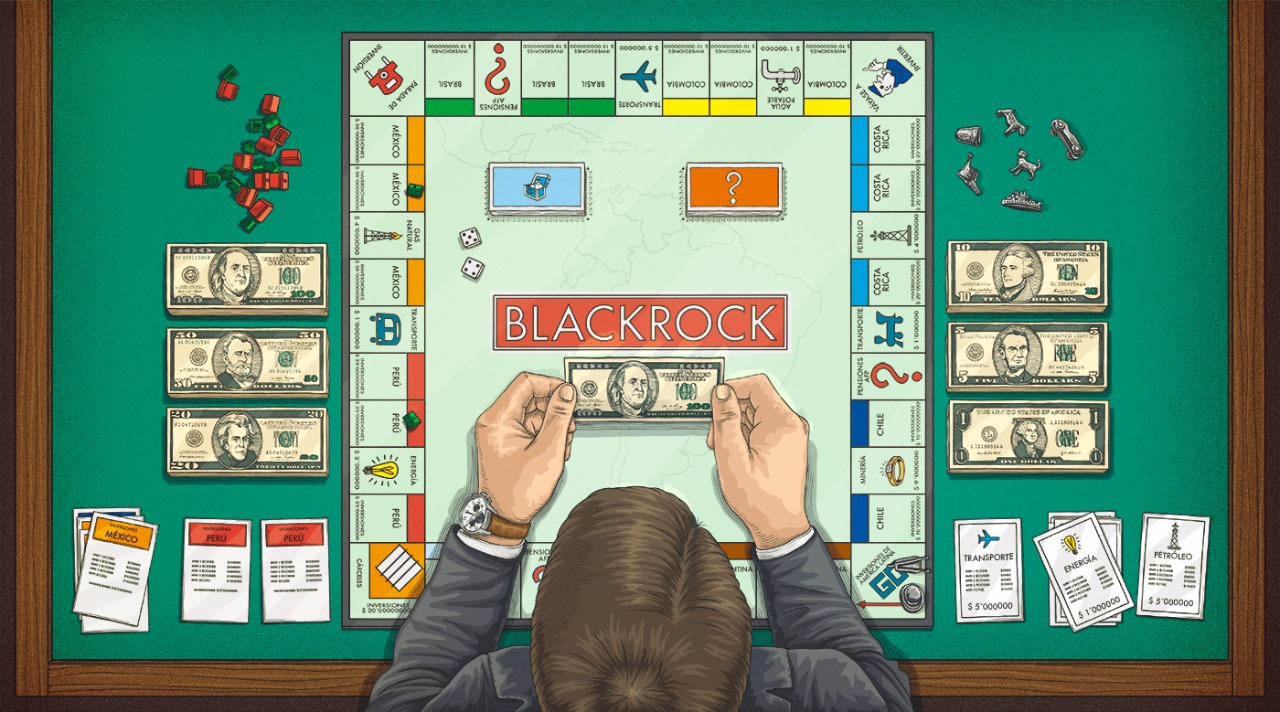

Their pension funds are managed, through individual accounts, mostly by private firms. These companies receive a commission for making the money profitable through their investment decisions. The dissemination of this mechanism began in Chile 40 years ago.

Those private firms are known as AFPs in Chile, Peru, Colombia, El Salvador, and the Dominican Republic; as AFAPs in Uruguay; Afore in Mexico; and as OPCs in Costa Rica. Only in Panama are individual accounts managed by the state.

Where Is My Pension? reveals cases of companies that you probably would not have wanted to finance with if you had a say in it: environmental violators, labor violators, and companies investigated for corruption; as well as the role of workers as forced financiers of their governments.